Buoyed by a rising real estate market, the Martha’s Vineyard Land Bank is on track to end the year on a high note for revenues.

Through the third week in December, the land bank had collected nearly $13 million in revenues, a 38 per cent increase over the previous calendar year.

The land bank collects a two per cent fee on most arm’s length real estate transactions and uses the money to buy public conservation land, including beaches, farmland, scenic vistas and aquifer protection. Fees are paid by buyers; there are a few exemptions, including for first-time home buyers.

The land bank tracks its revenues both on a fiscal and calendar year basis. Viewed either way, this has been a strong year for the Island’s only public conservation agency.

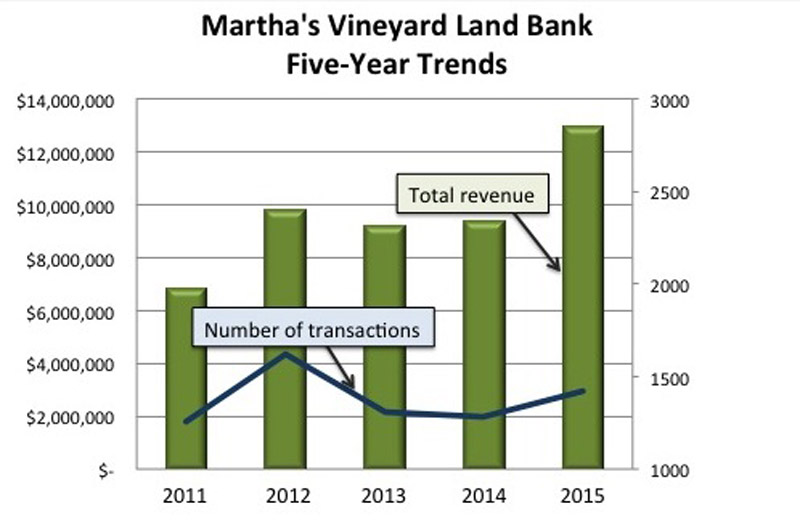

Statistics provided by the land bank this week show a general upward trend over the past five years. At the close of calendar year 2011, the land bank had collected $6.8 million from 1,253 qualifying real estate transactions. In 2012 the number climbed to $9.8 million on 1,617 transactions. The next year the number fell slightly, with $9.2 million on 1,304 transactions. In 2014 the land bank collected $9.3 million on 1,286 transactions. This year the growth trend saw a significant climb, with the land bank collecting $12.9 million on 1,424 transactions.

Fiscal year trends (running from July 1 through June 30 annually) follow a similar pattern. In fiscal year 2011 the land bank collected $7.7 million from 1,228 transactions; this year the number climbed to $10.8 million from 1,281 transactions.

Land bank executive director James Lengyel said the numbers speak for themselves.

“They show what is already known to anyone observing the market — there is real growth,” he said, noting that revenues are now outpacing the number of transactions on the growth scale.

The land bank also analyzes its numbers by dividing sales into three broad sectors: low (under $499,999), middle ($500,000 to $999,999) and high (over $1 million). “This is where we try to suss out what is driving most of the real estate sales,” he said.

The analysis shows that this year the middle of the market is driving sales, a change from recent years when the lower market saw the most activity. The top sector is consistently strong on the Vineyard, which is primarily a second home real estate market.

From July to December this year, 34 per cent of land bank revenues could be tracked to transactions in the low sector, while 38 per cent came from the middle and 28 per cent from the top sector.

And while middle of the market may be driving sales, the top sector broke records for the land bank this year. In February the land bank collected more than $1 million in a single five-day period, a record for the agency. Several large property sales contributed to the windfall, including a $22 million single-family home sale in Edgartown.

And if history repeats, the Island real estate market is likely nearing the top of an eight-year curve. Since its inception in 1986, land bank revenues have showed a consistent pattern of eight-year ups and downs.

“It’s sort of a chestnut, but it does basically follow roughly an eight-year cycle,” Mr. Lengyel said. The last peak period for revenues at the land bank was 2006, just before the national economy crashed. Mr. Lengyel said 2008 marked the lowest ebb for land bank revenues in the contemporary era. Total revenues that year were $5.7 million.

Meanwhile, rising revenues at the land bank translate to more ability to buy conservation land, and this year saw brisk activity.

Among the highlights:

• In the spring the land bank completed a long-planned purchase of 31 acres of rare coastal farmland at Tom’s Neck Farm on Chappaquiddick.

• This fall it took steps to expand its holdings at Ice House Pond in West Tisbury through the purchase of 22 acres.

• A month later, a strategic expansion at Fulling Mill Brook in Chilmark was completed with the purchase of 17 acres.

Mr. Lengyel said he is optimistic about the coming year. “In a rising market, some owners become sellers when they otherwise might not have been,” he said. “The land bank assumes there will be more opportunities on the supply side and more revenue on the demand side . . . . so we can consider things.”

Comments (4)

Comments

Comment policy »