On the cusp of the summer season and with housing sales overall on a steady upswing, homes at the lower end of the market on Martha’s Vineyard are being snapped up at a record clip, with hundreds vying for the handful of houses they can afford.

A survey of data available through the multiple-listing service LINK along with interviews with Island real estate brokers, confirms an insatiable and growing demand for homes selling for less than the median price of about $750,000.

“The minute something hits the market listed under $500,000, it’s not unheard of that it will go under agreement the same day,” LINK president Debra Blair told the Gazette this week. “That’s how much hidden demand there is for that first-time homebuyer.”

Some properties are being purchased for use as seasonal rentals, several brokers said, reducing what is available to the Island’s year-round workforce, already faced with limited housing options.

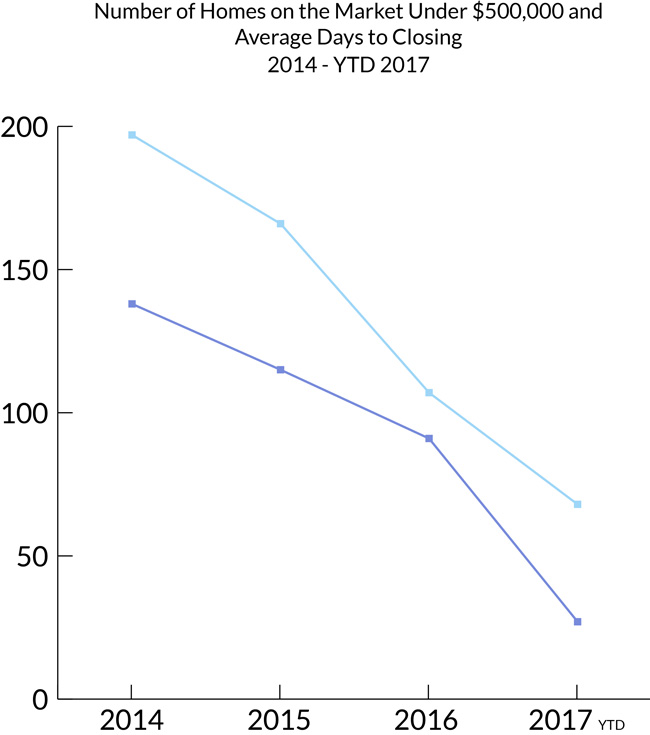

According to LINK, homes listed for under $500,000 (excluding condominiums) are selling almost three times as fast as the average for all sales, and twice as fast as they were at this time last year. On average this year, sales on those homes are closing just 68 days after being listed, although sales tend to spike in the spring.

“Right now in certain price ranges it’s very much a seller’s market,” said Alan Schweikert, owner of Ocean Park Realty in Oak Bluffs. “If a house comes up at $500,000 . . . you almost have to say, we are going to have all showings between 2 and 4 in the afternoon, because you just can’t book all the people at once.”

Total inventory for all price ranges on the Island fell from 498 in 2014 to 322 last year, with only five single-family homes now listed for under $500,000. A total of 91 homes in that range sold last year, with an average 107 days on market.

Brokers highlight a number of likely causes for the recent trend. Arthur Smadbeck of Priestley, Smadbeck and Mone in Edgartown, pointed to a “perfect storm” of low inventory, low interest rates and an economy on the mend after the national recession that began in 2007.

“The reasons for a lot of this are very complicated,” he said. “It’s not as simple as saying there is no inventory.” He ticked off a few likely factors, including a sense of urgency among buyers who fear their interest rates will go up next year, and a renewed interest in homes as alternate investments.

The Island real estate market as a whole posted moderate growth last year, outperforming the previous year at both the higher and lower ends. An annual report by the West Tisbury brokerage firm Tea Lane Associates in January noted more sales above $3 million than in any year since 2003, and a similar trend for homes under $1 million. Almost all lower-end homes (some brokers set the threshold as high as $700,000) were sold down-Island, with the highest number in Oak Bluffs.

The median household income in Dukes County has fallen in recent years, dropping from $69,760 in 2011 to $64,222 in 2015, pointing to an increasing affordability gap for residents hoping to buy a home on Martha’s Vineyard.

Real estate broker Doug Reece, who owns RE/MAX On Island, noted that in addition to low interest rates and population growth, a decline in new construction has contributed to the demand for homes listed for under $600,000.

“In the rest of the world, typically builders can help with the inventory problem by building spec homes to meet the demand,” he said. “But the cost of land here just doesn’t allow for that to happen.”

He added that sellers now appear to be testing the upper limits of the market. As one indication, he noted that while the median price of properties sold has risen slightly since last year, the figure doubles to $1.65 million when looking at all homes currently on the market.

“Everybody likes to take advantage of an up-market,” he said. “And that’s okay. But when you see the median price being double what the median price sold is, you wonder where the market’s going to go. You’ve got to wonder at what point a buyer is going to say, no, we’re not going there. So this is going to be an interesting year coming up.”

Mr. Smadbeck, who is also an Edgartown selectman, noted that when sale prices exceed a property’s assessed value, as they often do on the Island, that’s another indication of a market on the rise. In many cases, he said, assessed values are simply outdated by the time a property sells.

A review of LINK data shows that of the 28 single and multi-family homes that sold for under $600,000 in Edgartown last year, about two thirds sold for more than their assessed value — tracking an increase in that figure since at least 2012.

In addition, 23 properties on the Island last year sold for more than their asking price, according to LINK, including nine originally listed for under $600,000. That marks an increase from two to five per cent since in 2014, although Eleanor Wilson, client services specialist for LINK, said it was hard to draw firm conclusions from such a small sample. “It’s not a big enough pool to really claim a statistical trend coming out of it,” she said.

Mr. Schweikert agreed that more sales now are exceeding the asking price, but he added that some sales also fall short, especially for houses in the lower end that need repairs or renovations.

Buyers often search for years before finding the right property — a trend that Mr. Reece said plays out whenever a new property comes on the market. “There is a pool of buyers out there, and they’ve seen everything else,” he said. “So when something new comes on the market, there is a feeding frenzy of buyers to get to that property.”

Spring and summer typically see the fiercest competition, since buyers are eager to occupy or rent the properties during the high season. Conversely, owners are often anxious to sell in the fall so they don’t have to carry their expenses through the winter.

Mr. Schweikert said buyers at the lower end tend to be Islanders who have rented for years and have enough income to qualify for a first-time homebuyer mortgage. “There are a lot of banks helping them out,” he said. “That is most of the people looking at those houses.”

But many houses also sell as rental investments. Mr. Reece said about 70 per cent of his total business involves vacation homes that are rented part of the year to help cover at least some of the costs. “The other 30 per cent would be year-round folks,” he said.

Whether the frenzied buying at the lower end of the market will continue this year depends in part on what happens with the national economy, including a projected rise in interest rates, which could steer things in a new direction.

Mr. Reece predicted that the number of sales would eventually stabilize in light of the low inventory, and that average and median home prices would continue to rise in line with demand.

“I think we are going to see the rest of this up-market for another two to three years,” he said, “at which point we’re going to see a correction in the market, and it’s going to go down again. I don’t think it’s a problem, I just see it as traditional real estate cycles. Everyone will adjust.”

Mr. Smadbeck had a similar outlook, although he worried about so many properties being rented for just part of the year, since it removes them from the year-round housing stock. He noted the pressure that places on young families trying to put down roots on the Island.

“It’s no secret we have a big housing problem,” he said.

Comments (4)

Comments

Comment policy »