For anyone who has ever wondered how Wall Street hedge fund managers sleep at night and look themselves in the mirror in the morning, having spent the preceding day bilking clients, Men of Gain by Hunter McClelland (Strategic Book Publishing, $12.95) will give you a good idea of how this feels from the inside out.

Evan Tipton 2nd is an aforementioned hedge fund manager, with a home in Boston and summers on (where else?) Martha’s Vineyard, a lovely wife, and two sons whose school halls are decked with ivy. But from the very first paragraph, some specter of trouble lurks in Evan’s psyche: “He felt numb, flooded, overwhelmed with thoughts and their assorted corresponding feelings . . . Frantically and futilely he examined recent history, but he would have to reconsider years, not months.”

What’s gone wrong in his idyllic life? Well, what’s wrong is he’s about to be caught up in one of the largest security scandals in modern history. How he copes with the overwhelming repercussions, the effect on his family, his social life, and the strong possibility of a desolate future, lets us in on the personal horrors of fiduciary irresponsibility. We may be flooded with news of misbehaving executives, fanning themselves with big bonus checks, but this book makes clear that some of the miscreants are in the deep yogurt.

It’s not as wrenching a story as, say, losing your father, having your mother marry the man who murdered him who also happens to be your Uncle Claudius, stabbing your girlfriend’s dad through something called an arras, after which the girlfriend drowns herself, and so on and so forth, but hey, everyone’s allotment of misery makes for interesting reading.

By this time we all have a sense that corporate executives are knuckle-headed sociopaths, too dumb to keep from running their companies into the ground, yet so lacking in conscience that they’re willing to pillage and plunder everything that can be carted away even as the edifice falls.

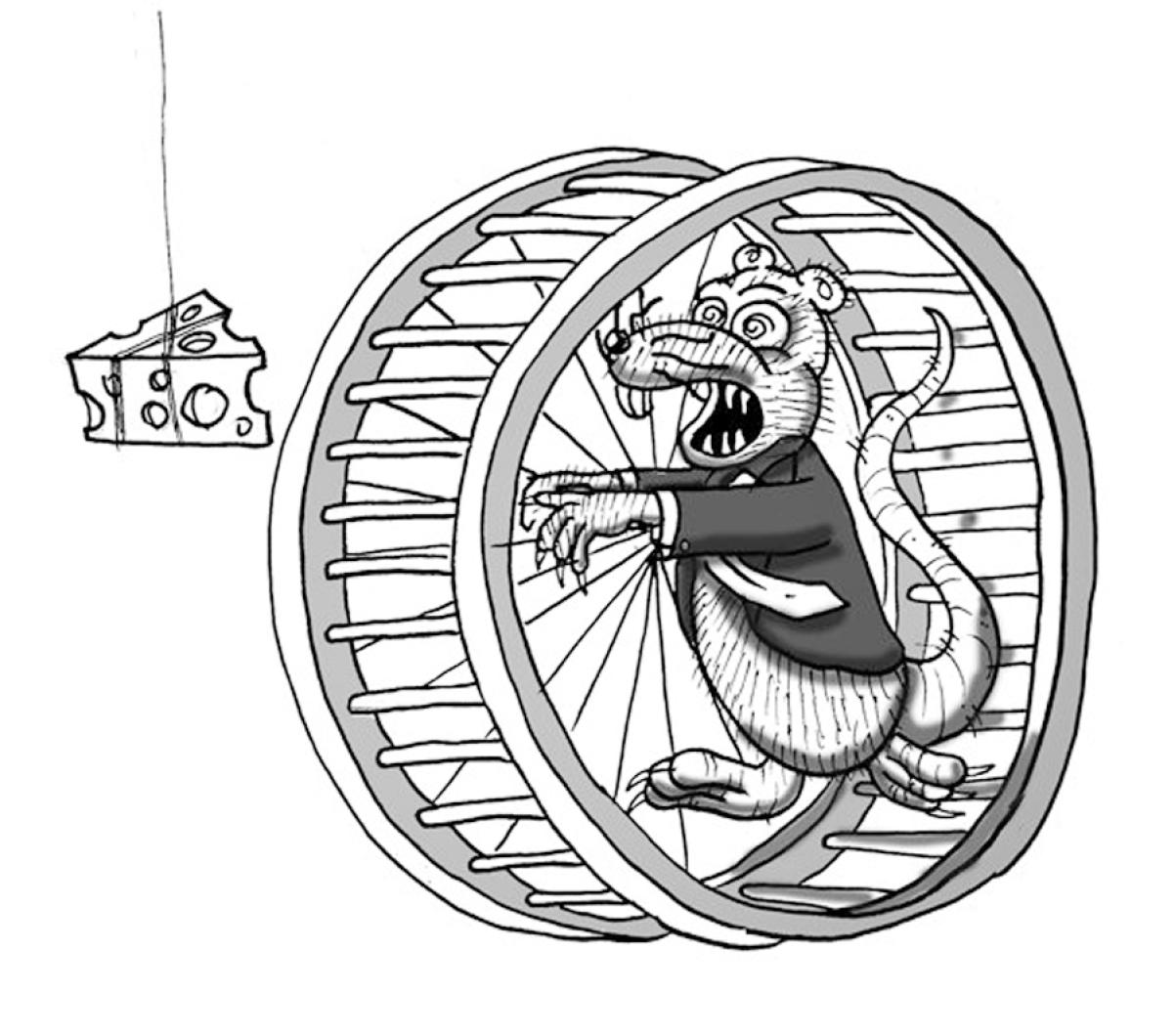

In The King Rat and His Court, Lessons in Corporate Greed, by Vineyard Haven and Pittsburgh resident William Arthur Bruno, illustrated by Eduardo del Rio (BookSurge Publishing, $15), this indictment of wickedly selfish and destructive CEOs goes beyond identifying the villains as psychopaths straight out of the psychiatric DSM IV and compares them to the most loathed of earthly creatures, i.e. rats.

Mr. Bruno borrows the conceit from various scientific studies of rodent behavior, including B. F. Skinner’s 1938 observation in The Behavior of Organisms: “I may say that the only difference I expect to see revealed between the behaviors of rat and man (aside from enormous differences in complexity) lie in the field of verbal behavior.”

Mr. Bruno demonstrates how CEOs and their minions swarm over board members, stockholders, employees and the public itself to gobble up money and power the way rats tear through mazes to get to the cheese. Along the way, we see how the minions, either wittingly or unwittingly, conspire with their higher-ups, from the chief financial operator, whose job it is to keep the financially illiterate CEO and his cronies out of jail, to the lawyers adept at burying wrongdoing under a mountain of paper trails, obfuscating memos, and specious board approvals, to accountants who are similarly talented at pointing blame in every which direction but up.

For all of us who’ve gnashed our teeth over congressional hearings about corporate bailouts paid out of taxpayers’ dollars, to the financial apocalypse that slammed Wall Street harder than the tidal wave in the movie The Day After Tomorrow, this book that nails the rats in the system and how they work it, helps to vindicate our sense of injustice. Mr. del Rio’s amusing cartoons of leering rodentia in jackets and ties and lugging valises bulging, one assumes, with ill-gotten gains, add to the charming account of uncharming behaviors.

This is a must-read for anyone seeking a crash course in how unregulated executives for years have been acting like, well, rats (or fill in an expletive of your own choosing).

Our nonfiction literature has been populated recently by a variety of books dedicated to the moral quagmire of big business. In recalling Bill Bennet’s exhaustive tomes, I and II, America, The Last Best Hope, to the Tipping Point and other works that enjoin us to use a moral compass in conducting our business affairs, we may wonder if the wrong people have been reading these books.

While we wait for the federal government to legislate a new set of crime-busting regulations, we might all of us wish to educate ourselves on how bad choices make bad guys out of a great many denizens of America’s business classes.

Comments

Comment policy »