Though the names of the players keep changing, banking remains a healthy business on Martha’s Vineyard with more than $800 million in deposits in 15 branches Islandwide, up $200 million from just a decade ago.

Today, four banks maintain a physical presence on the Vineyard, ranging from the Island-based Martha’s Vineyard Savings Bank to the global giant Santander, whose headquarters are in Spain. Rockland Trust, which acquired the former Edgartown National Bank a year ago, and Cape Cod Five, which opened its second Island branch less than two weeks ago, fill out the roster.

Presidents and regional managers of each Island bank interviewed by the Gazette acknowledged the many challenges faced by community banks including staying relevant in the face of rapidly changing technology and keeping money safe against growing threats to cybersecurity. A recent national survey of community bankers by the ABA Banking Journal found that acquiring new customers and regulatory concerns were the top issues keeping them up at night.

But leaders of Vineyard banks were bullish about the opportunity for growth on the Island and expansive on their beneficial role in the local economy.

“Community banks feel that we are in a position to be helpful in strengthening communities and helping them grow. We feel a responsibility to these communities that is heartfelt and personal because we live in the communities ourselves,” said Christopher Oddleifson, CEO of Rockland Trust, which has four branches on the Vineyard.

If there was a common theme among the bankers interviewed, it was their focus on community investment, though only two of the four — MV Savings and Cape Cod Five — fit the narrow criteria of a community bank as defined by the Federal Deposit Insurance Corporation, which regulates banking.

Bankers described their support for the Island economy in a variety of ways, from granting loans to small businesses and providing mortgages for homeowners to employing local workers and giving to charitable causes.

“Our community brand is the people that work in the branches,” said Cynthia Lariviere, regional president for Santander, which employs 10 full-time people in its two remaining branches on the Island. Santander closed its Vineyard Haven branch and one of its Edgartown branches last fall in what she described as a move to consolidate service.

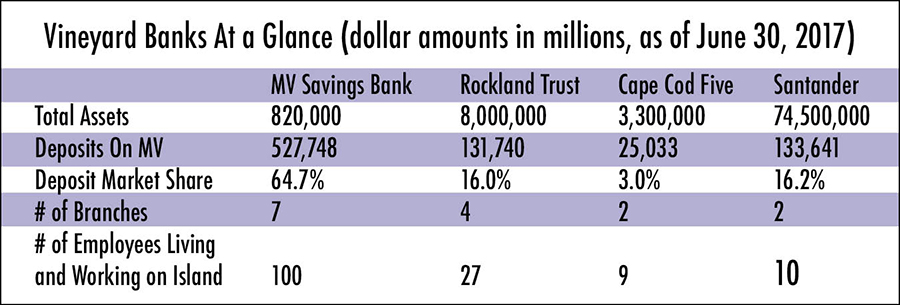

“I think the silent undercurrent is the circulation of money that goes on from the bank to employees back into community and to nonprofits,” said Martha’s Vineyard Savings Bank chief executive officer James Anthony. His bank has the largest presence on the Vineyard, with seven branches and 100 employees. Its two other branches are in Falmouth. Total assets were almost $820 million as of March of this year.

The savings bank also holds the highest market share of the group in terms of total deposits in Dukes County, with nearly 65 per cent of the market as of July 2017, according to data collected by the FDIC. Financials for the fiscal year ending June 2018 won’t be available publicly for several months.

That market share has grown steadily from 58 per cent since it was created from the merger of Dukes County Savings Bank and Martha’s Vineyard Cooperative Bank in 2007.

Market share for Santander and Rockland is roughly 16 per cent, a step down from shares of nearly 20 per cent under previous ownership. Santander acquired Sovereign Bank in late 2008 and Rockland Trust took over Edgartown National Bank last spring. Santander, with worldwide assets of $74 billion, has 640 branches in the U.S.

Rockland is a regional bank based in Rockland, with $8 billion in assets.

Cape Cod Five, which opened a second branch in Edgartown in late June, held three per cent of the market last year when it only had one branch on Island.

Richard Leonard, regional president for Cape Cod Five, said: “It’s a clear indication that by opening another location we are experiencing demand for our services.”

For a bank to be technically designated a community bank, it must have not more than 87 branches in fewer than three metropolitan areas and hold under $1 billion in assets. Rockland Trust, with 88 branches, narrowly misses the designation.

But under the Community Reinvestment Act, first passed in 1977 to ensure that banks meet the credit needs of the communities in which they operate, all banks are reviewed regularly on their performance against certain benchmarks. Banks are scored on a four-point scale from “Substantial Noncompliance” to “Outstanding.”

Examiners decide on a score by looking at several factors including the volume and amount of loans given out to communities by the bank, and the amount of charitable contributions.

There are no specific requirements for compliance, but a bank that receives a low CRA score may lose the trust of their community and suffer financially, according to Thomas Curry, a partner and co-leader of banking and financial services group at Nutter McClennen & Fish Law Firm in Boston,

“The primary impact of it is a public shaming,” he said, speaking of the CRA score. “Banks want to have a good reputation in the communities, so they try to have at least a satisfactory rating.” The most recent CRA reviews across the four Island banks show Cape Cod Five as the only bank with an outstanding record, with the other three holding a satisfactory score. Five employees of Cape Cod Five were listed as the top residential loan generators in 2017 for Massachusetts out of the four banks, giving out more than 850 loans of about $350 million between them.

“We’re very proud of the fact that we’ve maintained our outstanding rating,” said Dorothy Savarese, CEO of Cape Cod Five. “We think of CRA as the floor, not the ceiling.”

Based on year-to-date 2018 charitable giving to Island organizations, Martha’s Vineyard Savings Bank leads the other banks with just over $118,000, according to documents provided to the Gazette by the four banks. The bank did not

provide a list of what organizations the funds were allocated to.

“CRA ratings are a good measure, but they are not the greatest measure,” said Mr. Anthony. “We measure on how much we contribute back to the community. We think of it as dividends to our shareholders.”

Rockland Trust has given out more than $48,000 in contributions and sponsorships, with two $10,000 donations going to the Island Housing Trust and Vineyard Trust. Several smaller grants were given out to sports groups and community service organizations.

Cape Cod Five lists about $38,000 in giving on the Vineyard toward 21 organizations, with the highest grant of nearly $6,000 going to Martha’s Vineyard Community Services.

Santander has given out just one grant of $10,000 to the Island Housing Trust as part of the first round of its yearly giving.

Mr. Leonard of Cape Cod Five noted that charitable donations are only one measure of investment.

“Community banking plays a critical role in providing financial services to individuals and families,” he said. “The need for community banking to me is greater every day.”

Looking to the future, Mr. Anthony said that small banks like MV Savings actually can have an advantage over larger banks in their ability to be nimble, particularly in adopting new technology.

“They’re more agile and don’t have enormous legacies of billions of dollars of deposits and loans that are on a particular system,” he said.

Mr. Anthony added that the relatively stable housing market of the Island is a huge opportunity for banks and he expects small banks to lead future growth on the Island.

“The future of community banking is bright, but not for all community banks,” he said.

Comments (3)

Comments

Comment policy »